placer county tax deed sales

The current total local sales tax rate in Placer County CA is 7250. These forms of taxation represent amounts of money added to the property tax established by the local authorities and applied to each household unit.

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

2954 Richardson Dr Auburn California 95603.

. Placer County sells tax deed properties at the Placer County tax sale auction which is held annually during the month of October each year. Find Placer County residential property records including deed records titles mortgages sales transfers ownership history parcel land zoning structural descriptions valuations tax assessments more. There are currently 345 Sheriff Sale homes listed for auction in Placer County CA.

Pay My Taxes Tax Bill Search. To order by phone call 530-886-5610. For the 20202021 tax year they are 1079687582.

No tax lien sales have been held to date. 3091 County Center Dr Auburn CA. Listing Results Page 1 - 25 of 345.

Look Up Property Records. Placer County CA currently has 345 tax liens available as of February 16. 3404 93rd Ave SW Olympia sold for 165200.

Find different option for paying your property taxes. And the sale begins at 10 am. 18 if tax lien auctions are held.

Official records may be ordered over the phone with a credit card. Search for your dream home today. Ad Ownerly Helps You Find Data On Homeowner Property Taxes Deeds Estimated Value More.

Placer County Property Records are real estate documents that contain information related to real property in Placer County California. This is the total of state and county sales tax rates. These records can include Placer County property tax assessments and assessment challenges appraisals and income taxes.

Property Tax Bill Questions Answers. Then search through all the live real estate auction listings and government-seized properties in Placer County CA for the cheapest Sheriff Sales deal thats right for you. Free Placer County Recorder Of Deeds Property Records Search.

Ad Find Tax Foreclosures Under Market Value in California. Registration begins at 9 am. All cashiers checks must be made payable to the Placer County Tax Collector.

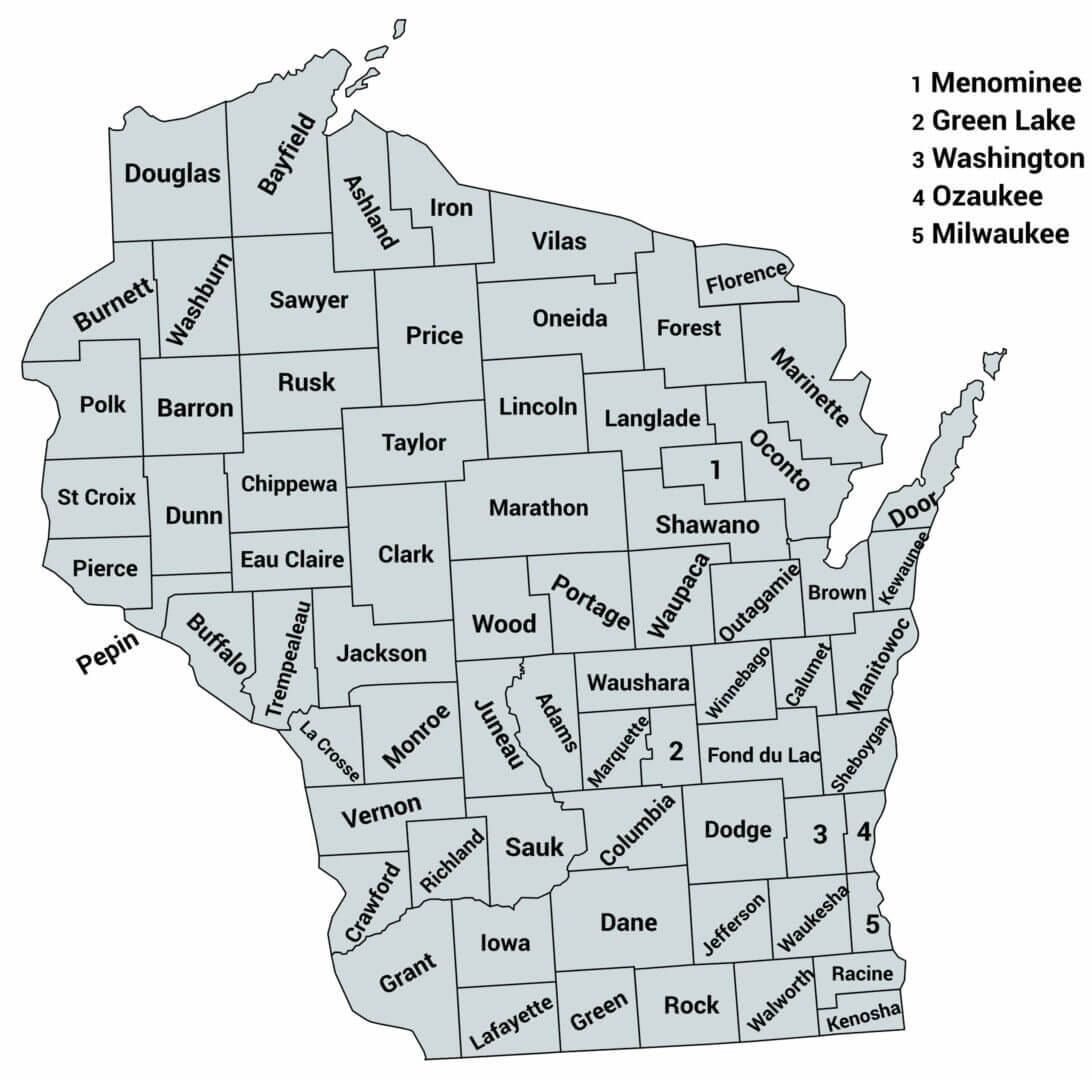

The California state sales tax rate is currently 6. Washington is one of many tax deed states and sells undeveloped lots as some of the county sales. Appeal your property tax bill penalty fees and validity of assessment date.

10 25 50 100. Search Any Address in Placer County Get A Detailed Property Report Quick. December 20 2021 properties postponed from the October 5th 2021 Tax Land Sale.

List of Parcels Subject to Tax Sale In December 2021. Checks - The Recorders Office does accept personal checks. Placer County relies on the revenue generated from real estate property taxes to fund daily services.

Ad Start Your Placer County Property Research Here. Some of these were waterfront lots which command a premium price. Search Valuable Data On Properties Such As Deeds Taxes Comps Pre-Foreclosures More.

California conducts many tax deed sales including some online conducted by. The Placer County sales tax rate is 025. Planning Commission Hearing Room.

Placer County Property Tax Records. The Placer County California sales tax is 725 the same as the California state sales taxWhile many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Placer County CA at tax lien auctions or online distressed asset sales.

The December 2020 total local sales tax rate was also 7250. View 13 in Placer County CA. Placer County Recorder-Clerk 2954 Richardson Drive Auburn CA 95603.

The Washoe County Treasurers Office holds auctions for delinquent property and mobile home taxes. The office collects over 230 different taxes including special assessments and direct charges. Find Placer County Tax Records.

Unpaid real estate taxes creates a serious cash-flow problem for Placer County. These buyers bid for an interest rate on the taxes owed and the right to collect. Community Resource Development Center.

Some townships in Placer County can apply other forms of taxation for the purpose of collecting public revenue. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Estimate your supplemental tax with Placer County.

2 to 3 years if tax lien auctions are held but varies depending on the county. A recent sale in Thurston County saw several vacant lots go on the auction block. The County Tax Collector collects taxes for more than 70 different taxing agencies within the county.

Mon to Fri 800 to 500 Recording until 400. Here is a summary of information for tax sales in California. No personal checks will be accepted.

Placer County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Placer County California. You can buy more than homes in a tax deed sale. Check out popular questions and answers regarding property taxes.

This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price exceeds 100. For an additional charge telephone orders can be sent via express courier or emailed. Public Property Records provide information on homes land or commercial properties including titles mortgages property.

All sales require full payment which includes the transfer tax and recording fee. The 2018 United States Supreme Court decision in. The minimum combined 2022 sales tax rate for Placer County California is 725.

Nevada State Law provides for the redemption of real estate properties up until 5 pm on the third business day before the day of the sale by a. The department has an annual budget of 38 million.

63 Monthly Sales Report Template Word Free To Edit Download Print Cocodoc

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

In Escrow Understanding The Process For Sellers Loans Loans Officer Marketing Ideas Escrow Process Transaction Coordinator Mortgage Tips

In Escrow Understanding The Process For Sellers Loans Loans Officer Marketing Ideas Escrow Process Transaction Coordinator Mortgage Loan Officer

63 Monthly Sales Report Template Word Free To Edit Download Print Cocodoc

Buying Tax Deeds In California Know The Rules Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Oppenheimer Multi State Municipal Trust

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas